Buyers Active, Sellers Staying Put, Price Gains in Line with Historical Norms

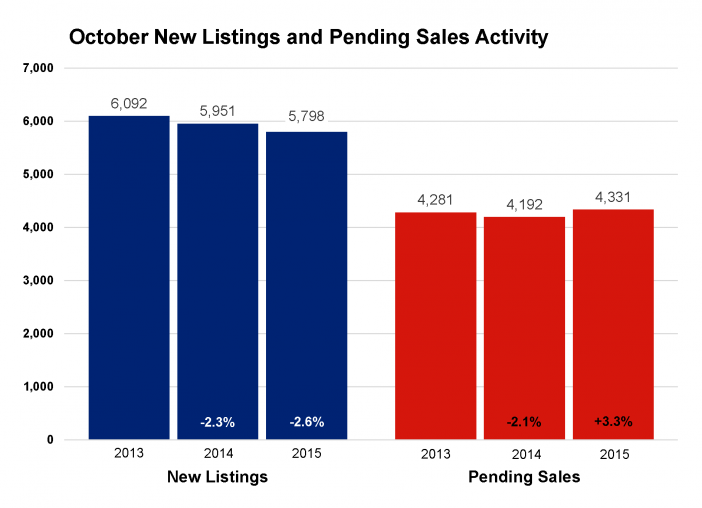

October pending sales rose 3.3 percent to 4,331 contracts. New listings decreased 2.6 percent to 5,798 as fewer sellers listed their properties for sale. It should come as no surprise that inventory levels fell 16.7 percent to 14,911 active units—extending a long-standing supply crunch that is frustrating some buyers but helping sellers yield multiple offers. As one might expect, prices thus continued to rise with the median sales price increasing 4.9 percent compared to last October. That is wholly in line with long-term year-over-year appreciation before factoring for inflation. The median list price rose 4.4 percent to $240,000, while the average price per square foot rose 3.2 percent to $127.

With tight supply and strong demand, sellers accepted a larger share of their original list price as offers were more competitive. The percent of original list price received at sale was up 1.1 percent to 96.2 percent. Homes tended to sell in less time. Days on market declined 2.8 percent to 70 days. Both of these trends are consistent with a sellers market. Further evidence that it’s a good time to sell came by way of months supply of inventory, which fell 25.6 percent to 3.2 months of supply. Generally, five to six months of supply is considered balanced. While the metro as a whole is favoring sellers, not all areas, segments and price points reflect that.

“Sellers are still a bit hesitant,” said Mike Hoffman, Minneapolis Area Association of REALTORS® (MAAR) President. “That said, factors such as low interest rates, rising rents, prices still below their peak and accelerating job and wage growth also paint a compelling picture for buyers.”

Other market measures show ongoing improvements as well. The percentage of all sales that were foreclosure or short sale has shrunk to less than 10.0 percent. Sales activity in the lower price ranges ($150,000 and below) is declining while activity in all other price ranges is rising. At the high end of the market, year-to-date sales activity in the $1,000,000 and up range has reached all-time record highs. Though it’s not yet the case for the entire region, home prices across several local markets including St. Louis Park, Edina and Southwest Minneapolis have also reached record highs.

The broader economy has been favorable to market recovery. The October jobs report not only beat expectations but it also showed the strongest wage growth in six years—a critical factor that will offset declining affordability and help with down payments. Unemployment has been cut in half from its peak and consumer confidence is rising. October Bureau of Labor Statistics figures show the Minneapolis-St. Paul-Bloomington metropolitan area had the lowest unemployment rate of any major metro at 3.1 percent compared to 5.0 percent nationally. Mortgage rates are still around 4.0 percent compared to a long-term average of over 7.0 percent. A rate hike at the Federal Reserve is expected in December, though changes in mortgage rates will be slow and incremental.

“As we near the end of 2015, it’s clear that home buyers were motivated and eager to make their move,” said Judy Shields, MAAR President-Elect. “Moving forward, we’ll be watching the affordability environment, inventory levels and new construction as we adapt to changing consumer preferences and a changing interest rate climate.”

From The Skinny Blog.

Weekly Market Report

For Week Ending November 14, 2015

For the next several weeks, activity will be lower than it is during the rest of the year but not in complete hibernation. The quietest weeks of the season in residential real estate sales are traditionally from Thanksgiving to New Year’s Day. Generally, we see fewer new listings, less inventory and fewer sales than at any other time during the year. That said, higher year-over-year sales prices are common across the country thanks to things like high demand, low inventory and exceptional interest rates.

In the Twin Cities region, for the week ending November 14:

- New Listings increased 19.5% to 1,024

- Pending Sales increased 22.0% to 894

- Inventory decreased 16.5% to 14,606

For the month of October:

- Median Sales Price increased 4.2% to $216,500

- Days on Market decreased 2.8% to 70

- Percent of Original List Price Received increased 1.1% to 96.2%

- Months Supply of Inventory decreased 25.6% to 3.2

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Weekly Market Report

For Week Ending November 7, 2015

In a continually improving economy, what we might expect to happen is happening in the housing market. Sales and prices are generally up in year- over-year comparisons, and new listings are replenishing the market at a fairly steady clip. More sellers are still encouraged to enter the fray, as lower inventory continues to remain a point of some concern.

In the Twin Cities region, for the week ending November 7:

- New Listings increased 7.5% to 1,183

- Pending Sales increased 10.7% to 907

- Inventory decreased 16.2% to 14,850

For the month of October:

- Median Sales Price increased 4.4% to $217,000

- Days on Market decreased 2.8% to 70

- Percent of Original List Price Received increased 1.1% to 96.2%

- Months Supply of Inventory decreased 25.6% to 3.2

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Weekly Market Report

For Week Ending October 31, 2015

Softer September sales continue to be a stout topic for stats analysis. Rental prices are not so soft, however, and across many markets, rising prices are turning heads. More first-time homebuyers may jump at the chance to invest in their own homes. Much of the evidence still points to recovering market health.

In the Twin Cities region, for the week ending October 31:

- New Listings increased 1.9% to 1,096

- Pending Sales increased 0.6% to 933

- Inventory decreased 16.2% to 15,440

For the month of October:

- Median Sales Price increased 4.9% to $218,000

- Days on Market decreased 2.8% to 70

- Percent of Original List Price Received increased 1.1% to 96.2%

- Months Supply of Inventory decreased 25.6% to 3.2

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Weekly Market Report

For Week Ending October 24, 2015

Data analysis from September national numbers revealed that new home sales underperformed slightly from what was originally expected. Some say this indicates market cooling, but with October giving way to November, it means we will soon have another month of sales to prove or disprove naysayers.

In the Twin Cities region, for the week ending October 24:

- New Listings decreased 2.5% to 1,233

- Pending Sales increased 10.7% to 934

- Inventory decreased 15.7% to 15,650

For the month of September:

- Median Sales Price increased 8.1% to $221,650

- Days on Market decreased 8.5% to 65

- Percent of Original List Price Received increased 1.0% to 96.6%

- Months Supply of Inventory decreased 23.9% to 3.5

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

October Monthly Skinny Video

Weekly Market Report

For Week Ending October 17, 2015

Jobless claims have dropped once again, matching levels not seen since 1973. Housing sales have continued to perform well, which should not be a surprise to those active in the real estate industry. Good economic environments foster healthy housing, and persistent health should lead to a Federal Reserve rate hike before the year is over.

In the Twin Cities region, for the week ending October 17:

- New Listings decreased 0.2% to 1,301

- Pending Sales increased 9.8% to 1,001

- Inventory decreased 15.3% to 15,895

For the month of September:

- Median Sales Price increased 8.3% to $222,000

- Days on Market decreased 8.5% to 65

- Percent of Original List Price Received increased 1.0% to 96.6%

- Months Supply of Inventory decreased 26.1% to 3.4

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Weekly Market Report

For Week Ending October 10, 2015

Supply and demand drive housing prices, and this basic economic tenet has been in the spotlight recently, as inventory remains low across the country while prices continue to edge up in many locales. Cash investment has gobbled up supply in some regions, while a lack of new construction has hit the supply side in others. The truth remains that there is still healthy demand in most corners. Every market and situation is unique, so let’s track the listings and sales for the week in your area.

In the Twin Cities region, for the week ending October 10:

- New Listings increased 2.5% to 1,453

- Pending Sales increased 13.0% to 1,053

- Inventory decreased 14.7% to 16,048

For the month of September:

- Median Sales Price increased 8.3% to $222,000

- Days on Market decreased 8.5% to 65

- Percent of Original List Price Received increased 1.0% to 96.6%

- Months Supply of Inventory decreased 26.1% to 3.4

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

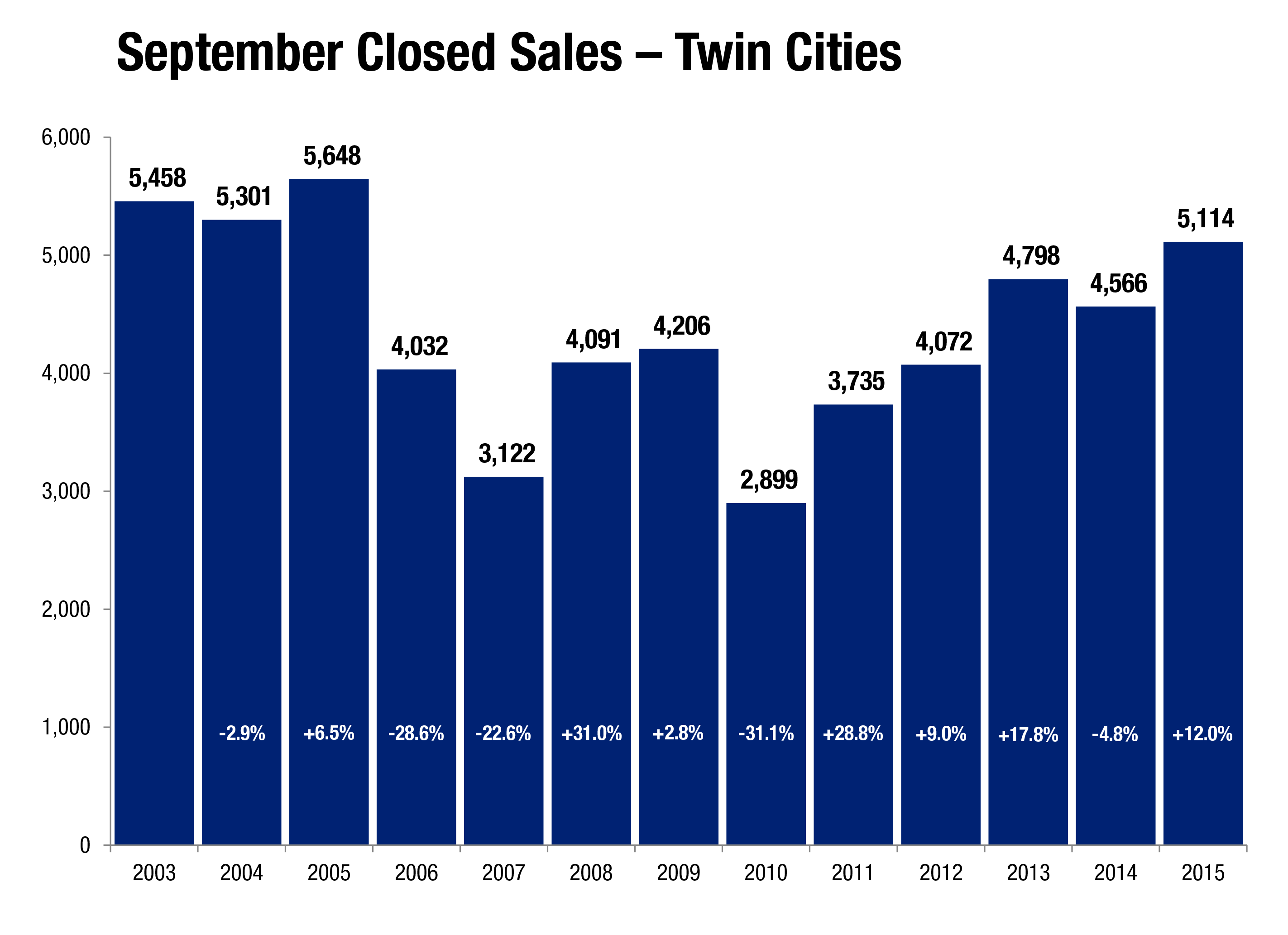

Twin Cities Housing Strong Heading into Fall

After an impressive summer, Twin Cities home sales continued at a 10-year record pace in September. Most indicators are beginning to show month-to-month moderation although year-over-year comparisons remain positive. The number of closed sales rose 12.0 percent to 5,114 homes. Fewer sellers listed their properties than last September, as new listings decreased 6.9 percent to 6,355. Inventory levels fell 16.0 percent to 15,928 active units. Prices continued to rise with the median sales price up 8.3 percent over last year.

Other price measures also continued to perform well. The median list price rose 2.1 percent to $245,000; while the average price per square foot rose 6.3 percent to $129. Sellers enjoyed their position of strength in the marketplace as the percent of original list price received at sale rose 1.0 percent to 96.6 percent. At 4,635 contracts signed, pending purchase activity also remains strong—12.3 percent above last September’s levels. On average, homes sold in less time. Days on market declined 8.5 percent to 65 days. This is consistent with a market leaning slightly towards sellers. Months supply of inventory fell a significant 26.1 percent to 3.4 months of supply. Generally, five to six months of supply is considered balanced. While the metro as a whole is favoring sellers, not all areas, segments and price points reflect that.

“September was another strong month for buyer activity,” said Mike Hoffman, Minneapolis Area Association of REALTORS® (MAAR) President. “Seller activity, however, remains restrained, meaning those who do choose to sell are getting top dollar in near-record time. The demand for homes is still exceeding the supply.”

Strong demand and low supply levels have created an environment where competitively-priced homes sell quickly and sometimes with multiple offers. This supply-demand imbalance, along with the “product mix shift” back to traditional sales, also means prices have risen for 43 consecutive months. The September 2015 median sales price rose 8.3 percent to $222,000 compared to a year-to-date increase of 6.8 percent to $220,000. Sellers are accepting offers at a median of 99.2 percent of their final list price.

Since housing doesn’t occur in a vacuum, it depends on other economic forces like a recovering labor market, job growth, favorable interest rates and confident consumers. Those factors have helped support our recovering housing market. We’re in the midst of the longest stretch of private job growth on record, unemployment has been cut in half from its peak and consumer confidence is rising. The latest Bureau of Labor Statistics figures show the Minneapolis-St. Paul-Bloomington metropolitan area had the second lowest unemployment rate of any major metro at 3.3 percent compared to 5.1 percent nationally. Mortgage rates are around 4.0 percent, compared to a long-term average of over 7.0 percent. The Federal Reserve is committed to lifting their key Federal Funds rate, a major factor affecting mortgage rates.

“We expect interest rates to stay below their long-term average for years to come,” said Judy Shields, MAAR President-Elect. “The trick will be sustaining price gains that motivate enough sellers to list their properties without pricing out today’s buyers—particularly first timers.”

From The Skinny Blog.

- « Previous Page

- 1

- …

- 23

- 24

- 25

- 26

- 27

- …

- 40

- Next Page »